Are you looking for funding to expand your business or to make sure your business stays strong throughout COVID-19? The SME Financing Guarantee Scheme (Scheme) might be the perfect option for you. The HKSAR government launched this program on 1 January 2011 to assist small and medium enterprises (SMEs) in securing loans from participating lending institutions (PLI), and SMEs often use these loans to expand their business operations or meet the working capital needs of their existing business.

The Scheme primarily consists of three special concessionary measures: (1) 80% Guarantee Coverage, (2) 90% Guarantee Coverage, and (3) Special 100% Loan Guarantee.

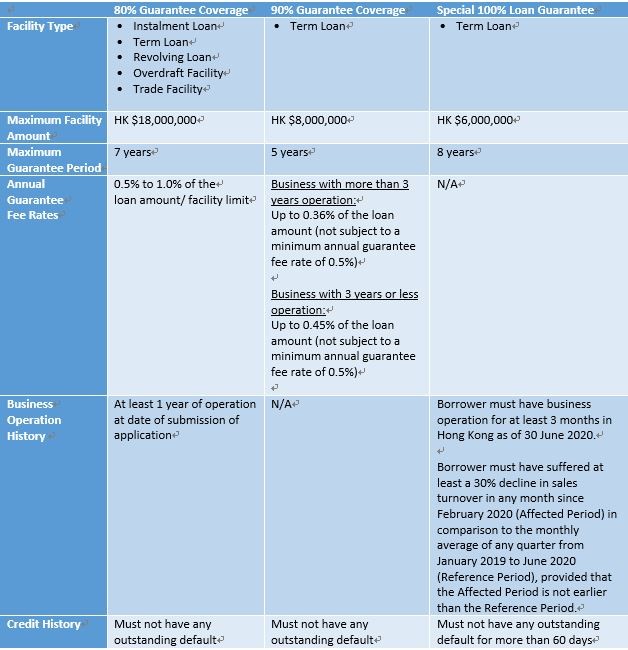

The major highlights of the Scheme’s features can be seen in table 1.

Table 1:

To be an eligible applicant under this Scheme, your business needs to satisfy all these criteria:

a) must be a company, sole proprietorship, partnership, or unincorporated body of persons which has business operation in Hong Kong and remains registered under the Business Registration Ordinance (Chapter 310 of the Laws of Hong Kong)

b) shall not be carrying on the business of a lender or otherwise providing funds available for borrowing in any way

c) shall not be an affiliate of the PLI

d) shall not be a company or corporation which has any of its shares listed on The Stock Exchange of Hong Kong Limited (whether on its Main Board or the Growth Enterprise Market) or any similar exchange in or outside of Hong Kong.

For more information, you may refer to the SME Financing Guarantee Scheme Factsheet here.

To apply for the Scheme, you should first apply to a PLI to confirm your eligibility and obtain approval. Then, together with the PLI, you will prepare and complete the application forms, including your business registration certificate, bank statements, latest audited financial statements, and proof of date of establishment (if your company has been operating for less than 18 months before the submission to the Hong Kong Mortgage Corporation Insurance Limited (HKMCI)).

Under normal circumstances, the HKMCI will issue a notification of the results to the PLI within 3 business days. You, as the successful applicant, will then receive documents to sign from the PLI for submission to the HKMCI, before you receive the official guarantee.

At last, the PLI collects the guarantee fee at your business’s respective rate from table 1, given you applied for a measure other than the Special 100% Loan Guarantee, or they will deduct the rate from your received funds.

The application period has recently been extended to 30 June 2022, with the maximum duration of principal moratorium for the above-mentioned Scheme being extended from 18 months to 24 months. As announced by the government of HKSAR on 8 October 2021, the guarantee limit has also been increased to HK $35 billion. However, it is allocated on a first-come-first-serve basis, so grab this opportunity for your liquidity protection while there is still time.

For SMEs, it can be difficult to receive loans or funds, but the SME Financing Guarantee Scheme makes it much easier. Whether you are just seeking the continual growth of your business or need some assistance to maintain your business’s position, the Scheme can provide you with the funds you need.